DEPOSIT SLIPS

Bosses turn bank workers into corporate bank robbers

“What is the robbing of a bank

compared to the founding of a bank?”

• Bertolt Brecht•

THEY DON’T SIGN UP TO BE BANK ROBBERS, but that’s what they become. That’s the reality for frontline workers at all of Canada’s five big banks.

The workers don’t rob banks, they rob bank customers on orders from their bosses. If they don’t they are likely to get fired. Hundreds of bank workers told the same story to a CBC Go Public investigation in spring 2017.

Workers at all five of Canada’s big banks told stories of the “do it or else” pressure they feel on the job. Their choice was to upsell, trick and even lie to customers to meet imposed sales targets—or else lose their jobs.

In nearly 1,000 emails, employees from RBC, BMO, CIBC, TD and Scotiabank locations across Canada told the CBC of pressures to hit sales targets that are monitored weekly, daily and in some cases hourly.

“Management is down your throat all the time,” said a Scotiabank financial adviser. “They want you to hit your numbers and it doesn’t matter how.”

Oh, what a dangerous web...

Bank workers told the CBC of the many devious tactics their bosses encouraged them to use to sell customers extra products and services—whether they needed them or not. Some workers admitted to even bending the law to hit their sales revenue targets.

For example, a teller who once worked at a TD branch in Windsor, Ontario told of how pressure to reach his sales quota lead him to increase a customer’s line of credit —without telling the customer. Not telling the customer was a violation of the federal Bank Act.

Another teller with over 20 years’ experience at an Ontario TD branch said she increased customers’ overdraft protection amounts without their knowledge, and increased their TD Visa card limits on the sly—all to earn units towards her sales revenue target.

A CIBC small business associate said the worst part of her job was having young families in her office who agreed to re-mortgage their homes to help with their debt.

“We told them we were helping them, but essentially we were extending more credit so the vicious cycle would continue and we, in turn, would make a sale.”

A former TD financial adviser in Calgary says, “I was forced to lie to customers, just to meet the sales revenue targets.”

“I’m in survival mode now,” says a teller who has worked at TD for more than 15 years, “because it’s a choice between keeping my job and feeding my family, or doing what’s right for the customer.”

“When I come into work, I have to put my ethics aside and forget about doing what’s right for the customer.”

They’ve got your number

Three of the bank workers who contacted Go Public explained how the banks use a computer program to help tellers upsell customers.

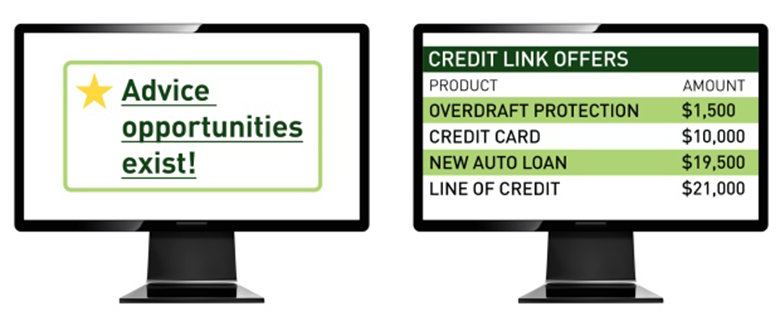

When a customer keys in a PIN at the teller counter, a gold star lights up on the teller’s computer screen, indicating that “Advice Opportunities Exist.”

When a teller clicks on the star, products and services the customer hasn’t purchased pop up, such as overdraft protection, credit card or line of credit.

Each time a teller gets a customer to sign up for one of those options, it counts towards meeting their sales targets.

“Customers are prey to me,” said one teller. “I will do anything I can to make my [sales] goal.”

Workers’ health takes a big hit

Many of the big five bank workers are so stressed by expectations to hit high sales targets, they take medical leave. Others simply have to quit.

A financial services manager who left BMO in Calgary last spring said he quit after having a full-blown panic attack in his branch manager’s office. She had threatened to scuttle his banking career because he hadn’t met sales targets.

An RBC certified financial planner in Guelph, Ontario told how: “Managers belittle you. We get weekly emails that highlight in red the people who are not hitting those sales targets. It’s bullying.”

Other workers sent the CBC team emails about their jobs causing “insomnia,” “nausea,” “anxiety” and “depression.”

Meanwhile, the banks sail on. The deceit they practice on their customers and the damage they do to their workers is no concern. There is just one concern: profits. And profits continue to be good—very, very good.

Canada’s Big 6 banks wrapped up the 2016 earnings season with $10.69 billion in total net profit—a hefty 13% annual increase.

Workers wages in Canada continue to flatline.

December 5, 2017

Bank CEOs make out like bandits--again

The country’s six biggest lenders set aside $14.3 billion for variable compensation — up 11 per cent from 2016 — as a record year in trading and investment banking swelled bonus pools. That’s the biggest jump since 2014 and stands in contrast to last year, when a 3.4 per cent increase was the lowest since 2010.

Add new comment