TAX FAVOURS

Tax collectors favour the rich over the rest of us

DEAD MONEY DOESN’T HELP US MUCH. And the rich have a lot of it. Too much.

Dead money is the kind the rich don’t spend. They don’t spend it on unimaginable luxuries, “philanthropic” virtuistic ventures, purchasing politicians, or through investment to acquire even more gold. They hide it.

In Canada, half-a-trillion dollars or so—is “dead,” meaning that it sits somewhere in a virtual vault, unspent and uninvested.

‘Dead money’ stays tax free

That’s obviously a problem: money that doesn’t circulate is doing nothing for the economy. But that problem is compounded by the fact that the current tax system—and the way it is administered by the Canada Revenue Agency—favours the rich, by providing tax loopholes that allow them to hide billions and avoid paying tax on any of it.

The tax system is complex, to put it mildly, and tax-avoidance loopholes abound, if you can afford to hire an army of accountants and lawyers. Huge sums of money—tens of billions—are squirreled away in tax havens off shore, and that’s just what’s reported. We can’t collect tax on any of it. In 2014, the annual cost in tax revenue to Canada was estimated to be around $8 billion.

But it gets worse. The CRA reserves its harshest treatment for the everyday folks who run mom-and-pop operations, like the Glebe Smoke Shop in Ottawa and two corner store Zesty Markets in Ottawa, for example. The agency joined with the RCMP to raid all three corner stores in 2016 because their agency “is committed to cracking down on tax evasion.” But ultra-wealthy tax cheats get much different treatment.

Different rules for big money

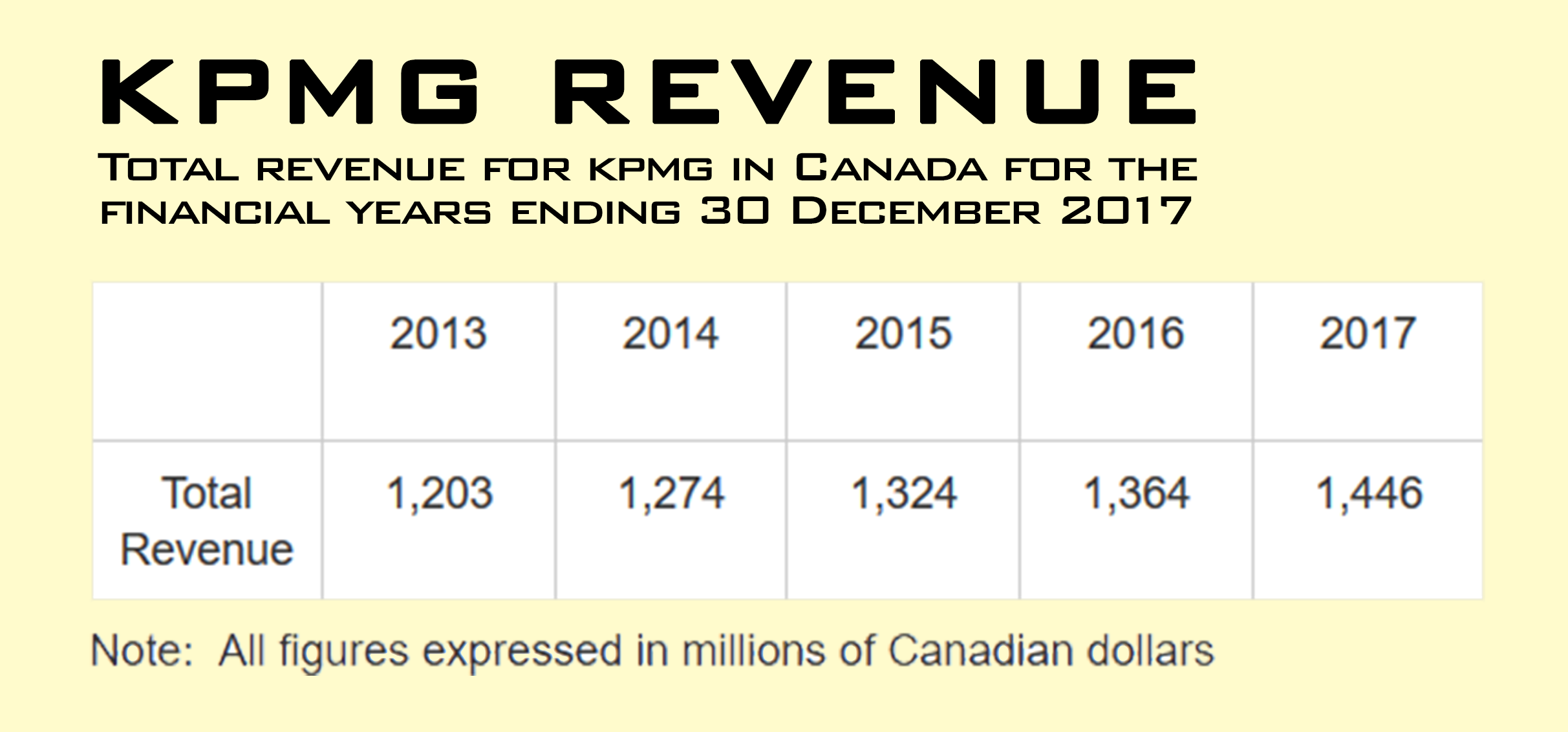

The accounting and investment firm KPMG ran an illegal, offshore, tax-dodging operation for many year. It allowed well-to-do clients to hide their profits on the Isle of Man, paying virtually no tax on them at all.

When this eventually came to light, senior CRA managers, sprang to the rescue of the rich—allegedly sparking anger among CRA employees. The managers arranged a sweetheart deal for KPMG, allowing its clients to avoid whopping penalties.

Relationships among KMPG, the CRA and the federal government, whether Conservative or Liberal, have always been cozy.

Top KPMG and CRA officials, during the initial CRA probe into the Isle of Man deal, enjoyed partying together. The previous Conservative government “partnered with” a top accounting firm to “advise” the CRA—while it was suing the agency on behalf of KPMG. (That government also slashed the numbers of CRA auditors whose job it was to investigate tax evasion.)

KPMG big wig Liberal Party treasurer

The Trudeau Liberals abruptly shut down a Parliamentary inquiry into the Isle of Man tax scandal—while, in that same month, a KPMG heavyweight was appointed as treasurer of the Liberal Party.

The government commissioned a third-party review of the KPMG by Dalhousie professor Kim Brooks, who “cleared” CRA of any impropriety (after vital correspondence had gone missing); she subsequently became the vice-chair of CRA’s allegedly arms-length offshore advisory committee.

Despite some effort to beef up CRA ranks to tackle tax evasion, the amount of unpaid tax is actually growing, while easy arrangements allow offshore investors to repatriate profits tax-free.

The Liberals are doing little or nothing to close tax loopholes that benefit the super-rich. Meanwhile, one of Trudeau`s closest friends and advisors has been taking full advantage of them.

The conclusions here are simple to draw: a rich KPMG client is safer from CRA enforcement than the owner of a corner convenience store. Wages will continue to be taxed at a substantially higher rate than investment income. Public services will be starved of resources, while billions of dollars are stashed offshore by the 1%.

So far Justin Trudeau`s promised “sunny ways,” are a lot sunnier for the 1% than the rest of us.

- 30 -

Taxman raids mom-and-pop stores

Add new comment